Having regular snapshots lets you track changes over time and catch errors early on. When the accountant or auditor reviews the accounting records, the adjusting entity will be made. It is only after all financial statements have been prepared that any adjusting entries can be entered into a general ledger or subsidiary ledgers. Start entering the balances for each account into the 1st column of an unadjusted trial balance spreadsheet (UBTB). A trial balance only contains ending balances of your accounting accounts, while the general ledger has detailed transactions of the accounts.

These adjusting entries have the effect of making certain that the total debits equal the total credits in each account. Before computers, a ledger was the main tool for ensuring debits and credits were equal. Mistakes here could throw off your entire trial balance sheet, leading to hours of extra work later on.

In order to create a true picture of your business, you should always prepare an income statement and balance sheet for the current month’s closing date. The unadjusted trial balance (UTB) is an important tool for monitoring your company’s operating results. Create a master list of accounts (assets, liabilities, equity, revenue & expenses) used in your company’s accounting system. It is “adjusted” because all of the transactions that have affected the organization’s accounts (both debit and credit) are included on it. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

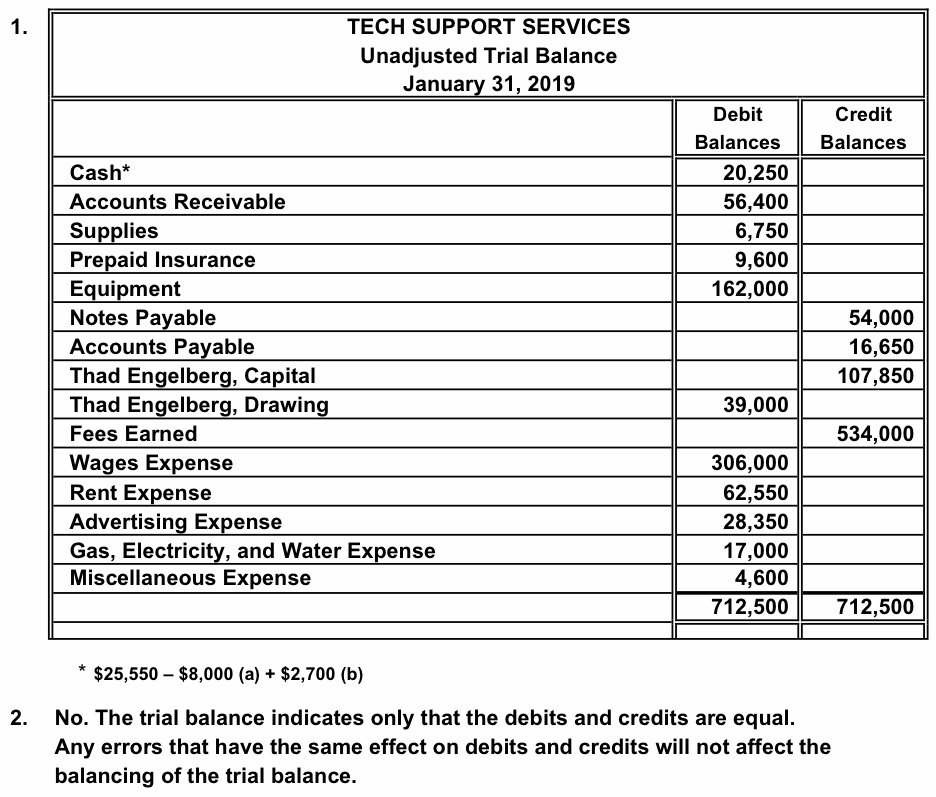

If they aren’t equal, the trial balance was prepared incorrectly or the journal entries weren’t transferred to the ledger accounts accurately. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

Each account with a balance in your accounting system, such as accounts receivable and accounts payable, appears in the trial balance with its respective balance–debits on the left and credits on the right. When they fix these issues, they can then move on to an adjusted trial balance and final financial statements with confidence. This involves a systematic process where each account’s debits and credits are methodically recorded as they stand before any end-of-period adjustments come into play. All we have to do is to list the balances of all the ledger accounts of a business. Both unadjusted and adjusted trial balances have an important role to play when it comes to being the source of transactions companies undertake.

Adjustments are typically needed for figures on an unadjusted trial balance because different calculations may be required to record entries more accurately or report accurate financial statements. An unadjusted trial balance is a list of all the company’s accounts and the balances in each account before any adjustments to the financial statements are made. As the bookkeepers and accountants examine the report and find errors in the accounts, they record adjusting journal entries to correct them.

An unadjusted trial balance is a listing of all the company’s accounts and their balances at a specific point in time, usually at the end of an accounting period before any adjusting entries have been made. An unadjusted trial balance plays a key role in preparing financial statements. Accountants look at it carefully to make sure every transaction is there. An unadjusted trial balance provides a snapshot of all transactions before any adjustments are made, acting as a checkpoint for accuracy.

In accordance with double entry accounting, both of the debit and credit columns are equal to each other. Business owners and accounting teams rely on the trial balance to create reliable financial statements. A trial balance ensures the accuracy of your accounting system and is just one of the many steps in the accounting cycle. Yes, every financial transaction from your company’s accounts during that period should appear on your unadjusted trial balance. No, you cannot determine profitability solely from the unadjusted trial balance because it doesn’t include adjustments for expenses and revenues that haven’t been recorded yet. Understanding how an unadjusted trial balance works keeps your company’s books in check.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. In the end, making sure you have a UTB to compare with your ATB is important because it will ensure that all accounts in your organization are accurate and complete.

The how to prepare an income statement is typically prepared toward the end of the accounting process. It is a financial statement that lists all the general ledger accounts’ debit and credit balances. Preparation of unadjusted trial balance is the fourth step in the accounting cycle after identification of a transaction, recording it in journal and posting it in to ledger. It lists all the ledger accounts in a summary form which will later be used in the financial statements. Step by step procedure for preparing an unadjusted trial balance is as follows. Following these adjustments, an “Adjusted Trial Balance” is prepared, which serves as the basis for preparing the financial statements of the entity.

An unadjusted trial balance is a list of all accounts as of the end of an accounting period. The balances on this trial balance sheet are usually taken from an account ledger or bookkeeping records. In an alternative format, the unadjusted trial balance may have a separate column for all debit balances and a separate column for all credit balances. This is useful for ensuring that the total of all debits equals the total of all credits.