That means there are likely to be confounding alternative causes of overhead variances, making them in turn less scientific. As long as you remember that budgeted quantities refer to the flexible budget, direct labor variances can be calculated in a way that is very similar to revenue variances. The products in a manufacturer’s inventory that are completed and are awaiting to be sold. You might view this account as containing the cost of the products in the finished goods warehouse.

That component of a product that has not yet been placed into the product or into work-in-process inventory. This account often contains the standard cost of the direct materials 7 reasons you havent received your tax refund on hand. A manufacturer must disclose in its financial statements the actual cost of materials on hand as well as its actual cost of work-in-process and finished goods.

The equation can provide you with a clearer picture of how the actual mix of inputs affected each input’s costs separately. In these situations, the quantity variance should be broken into mix and yield variances. A mix variance expresses variance due to differences the between the actual mix of substitutable inputs and the standard mix of those inputs. First, it was important to focus on the idea of not recording actual overhead.

For example, assume the firm purchases 10 ounces of a rare earth metal for $100 per ounce. Therefore actual cost is $1,000 and the debit to direct materials is $800. The $200 difference has to be a debit to the direct materials price variance account. One of the rules of thumb for variance analysis is that WIP receives all costs at standard.

Let’s assume that the Direct Materials Usage Variance account has a debit balance of $2,000 at the end of the accounting year. A debit balance is an unfavorable balance resulting from more direct materials being used than the standard amount allowed for the good output. Following is an illustration showing the flow of fixed costs into the Factory Overhead account, and on to Work in Process and the related variances. Actual fixed factory overhead may show little variation from budget. For instance, rent is usually subject to a lease agreement that is relatively certain. Even though budget and actual numbers may differ little in the aggregate, the underlying fixed overhead variances are nevertheless worthy of close inspection.

I cover this later in Section 7.8 because mix and yield variances are relevant to cost variances as well. When the 210,000 units arecompleted, the following entry is made to transfer the costs out ofwork-in-process inventory and into finished goods inventory. The first question to ask is “Why do we have this unfavorable variance of $2,000?

An unfavorable price variance suggests that the actual cost driver consumed cost more than was budgeted, i.e. that the firm paid more for some type of overhead than it should have. If you can remember that actual quantity will be different for quantity and price variances, you can calculate direct materials variances in a way that is very similar to direct labor variances. It’s important to separate out production volume as a cause of direct labor and direct materials quantity variances.

The production that is acceptable (not rejected products) and which is assigned manufacturing costs of direct materials, direct labor, and manufacturing overhead. Variable manufacturing overhead costs will increase in total as output increases. An example is the cost of the electricity needed to operate the machines that cut and sew the denim.

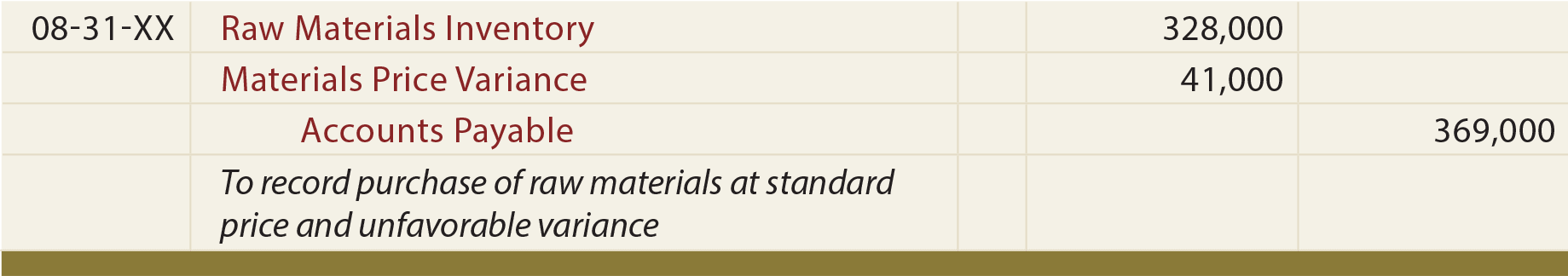

The difference between the debit and the credit goes to the direct materials quantity variance account. This chapter has focused on performing variance analysis toevaluate and control operations. Standard costing systems assist inthis process and often involve recording transactions usingstandard cost information. When accountants use a standard costingsystem to record transactions, companies are able to quicklyidentify variances. In addition, inventory and related cost ofgoods sold are valued using standard cost information, whichsimplifies the bookkeeping process.

Without knowing a sub-type of overhead cost that cost too much or the quality of the estimation that lead to the PDVOH rate in the first place, it is relatively hard to use this figure for evaluative purposes. Labor rate often become unfavorable when too few workers are employed (meaning overtime pay), more highly skilled worker time was required than budgeted, and benefits are higher than budgeted. Also notice that, for the above revenue calculations, quantity was expressed as a total figure and price was expressed per unit. Variance analysis helps the firm (in Step 2) trace actual costs to responsible sub-components of the firm and leads to revised expectations (in Step 3). If variance is the difference between budgeted results and actual results, then I can restate the profit equation as follows. One of the purposes of cost accounting is to hold people and things responsible for the costs they cause.

Variance analysis should also be performed to evaluate spending and utilization for factory overhead. Overhead variances are a bit more challenging to calculate and evaluate. As a result, the techniques for factory overhead evaluation vary considerably from company to company. To begin, recall that overhead has both variable and fixed components (unlike direct labor and direct material that are exclusively variable in nature). The variable components may consist of items like indirect material, indirect labor, and factory supplies.