At this point, you need to ask yourself whether your current plan is realistic or whether you need to raise prices, find a way to cut costs, or both. You should also consider whether your products will be successful on the market. Just because the break-even analysis determines the number of products you need to sell, there’s no guarantee that they will sell. Conversely, businesses with high variable costs, such as manufacturing companies, may focus on reducing production costs to reach their BEP faster. For instance, what happens if raw material costs rise or if the company is forced to lower its selling price to stay competitive?

The formula for break-even point (BEP) is very simple and calculation for the same is done by dividing the total fixed costs of production by the contribution margin per unit of product manufactured. This means you need to sell at least 67 units per month to cover your fixed and variable costs and break even. If your Break-Even Point is high, consider reducing your fixed and variable costs or increasing your sale price per unit to lower the number of units you need to sell to cover your costs. Whether you’re trying to promote your brand-new product, stay ahead of your competitors, or cut down on your expenses, you need to have a strategy in place. This helps you craft a more formidable strategy and reap better benefits for your company. In this case, you estimate how many units you need to sell, before you can start having actual profit.

Whether using Excel, online calculators, or accounting software, these tools simplify the break-even analysis process and provide valuable insights that guide pricing, budgeting, and growth strategies. This is particularly useful for businesses that want to regularly monitor their financial health and update break-even calculations as conditions change. This formula calculates the number of units you need to sell to break even. In this article, we’ll break down the break-even point formula, how to calculate it, the importance of its analysis, and more.

Calculating your potential payback period will depend on a lot of variables. Before you invite a crew of solar installers over, you’ll want to understand when — or if — the panels will start to pay for themselves. You might, like many Americans, want to help the environment by avoiding fossil fuels. Perhaps you want to protect your home from blackouts, a common problem during summer months. Or you might just want to stop worrying about paying for electricity.

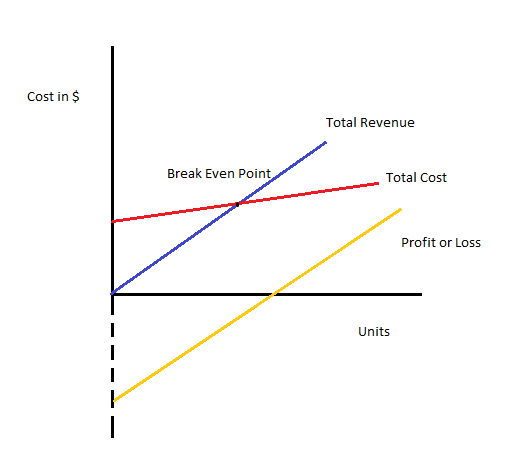

The break-even point is the moment in business when total revenue equals total costs, resulting in neither profit nor loss. At this point, a business covers all its expenses, both fixed (like rent or salaries) and variable (like materials or production costs). Beyond the break-even point, the business starts making a profit, while before best bookkeeping boston, ma 2023 it, there’s a net loss. Identifying the break-even point is crucial for businesses as it helps set pricing strategies, make informed financial decisions, and determine when profitability begins. These calculators typically ask for fixed costs, variable costs per unit, and the selling price, then compute the BEP in units or sales dollars.

That’s the difference between the number of units required to meet a profit goal and the required units that must be sold to cover the expenses. In our example, Barbara had to produce and sell 2,500 units to cover the factory expenditures and had to produce 3,500 units in order to meet her profit objectives. It’s the amount of sales the company can afford to lose but still cover its expenditures. Yes, the break-even point can change if your fixed or variable costs change, or if you change your pricing strategy.

It’s important to recalculate BEP when any major shifts occur in your business. Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. If your sales price is too low, you might have to sell too many units to break even. And as much as we think a lower price means more buyers, studies actually show that consumers rely on price to determine the quality of a product or service.

Production managers and executives have to be keenly aware of their level of sales and how close they are to covering fixed and variable costs at all times. That’s why they constantly try to change elements in the formulas reduce the number of units need to produce and increase profitability. Break-even analysis, or the comparison of sales to fixed costs, is a tool used by businesses and stock and option traders. It is essential in determining the minimum sales volume required to cover total costs and break even.

With break-even analysis, you can identify the time and price at which your business will turn profitable. This helps you plan the range of activities you need to reach that point, set up a turnaround time for your tasks, and stick to a timeline. Compare cost, overheads and business factors again return to calculate your break even point when selling multiple items/products. This is a step further from the base calculations, but having done the math on BEP beforehand, you can easily move on to more complex estimates.